In today's world of online shopping and bill servicing, credit cards

have become almost an essential part of our everyday lives. No one would

argue that they don't make life easier, but it's also true that they

have a dark side in that it's all to easy to build up debt.

Of course, it's simple to advise against getting into debt by

overspending with your card, but that advice is perhaps a little hollow

for people who have already built up a balance. If you're lucky, that

balance is not yet too much of a problem, but one almost guaranteed way

of setting your debt on the slippery slope is to continue spending with

your card while only making the minimum monthly repayment required by

your card issuer.

Each month when you receive your statement, the minimum amount you

have to pay will be clearly shown, and many people choose to have this

amount repaid automatically through their banks. This makes it easy to

keep your account up to date, and gives the illusion that you're keeping

on top of your card balance.

The problem lies in the size of the repayment you're making. In the

early days of plastic, the minimum repayment level was generally around

5% of the balance, but over the years this has drifted inexorably

downwards with 2.5% to 3% being the norm nowadays, with some cards going

as low as 2%.

Why is this a problem? Surely a lower repayment amount is

attractive, as your credit will cost you less each month, putting less

pressure on your budget? This is true to an extent, but the problem lies

in the long term. To get an idea of how bad an idea only paying the

minimum is, we need to look a bit more closely at your credit card

statement.

As well as showing the familiar annual interest rate, or APR, your

card statement will also show the monthly rate of interest charged on

your balance. A typical card might show a rate of around 1.6% a month.

In simple terms, this means that each month you will be charged 1.6% of

your balance in interest. Compare this to a 2% repayment, and you'll see

that over three quarters of everything you pay is swallowed up in

interest charges, leaving your original debt virtually untouched

This situation is bad enough, but it gets worse when you consider that

the interest rates charged on other ways of using your cards such as

instant cash or overseas use can be much higher. Monthly rates for

withdrawing cash, for example, can be nearly as high as the minimum

repayment percentage. If you withdraw a significant amount of cash

within a month, it's quite possible that the whole of your repayment can

go towards interest, with your debt level not reduced at all.

So even from this quick look at repayment levels, it's plain to see

that if you only make the minimum payment required on your statement,

you'll be prolonging the life of your debt by many years and vastly

increasing the amount of interest you'll be paying in total. How can you

avoid this?

The best way is to set up automatic payment of the minimum, so that

you'll be sure that every month you'll at least be staying within the

terms of your credit agreement and not risking damage to your credit

rating. Then, at the end of the month, make an extra payment of as much

as you can afford without borrowing from another source. Even if you

can't afford to pay a large amount, every little helps especially as all

of it will count towards reducing your balance and not servicing

interest charges.

Langganan:

Posting Komentar (Atom)

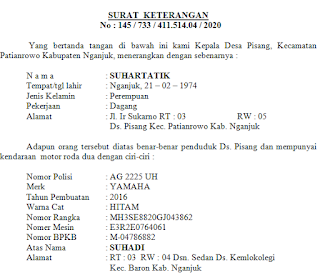

SURAT KETERANGAN STNK DAN BPKB untuk Hutang BANK

Surat ini biasanya untuk melengkapi administrasi pengajuan hutang ke Bank, biasanya juga disertai dengan SURAT KETERANGAN USAHA . monggo bi...

-

Alhamdulillah akhirnya AJ bisa post lagi......... lama juga AJ gk post. Langsung saja kali ini AJ akan berbagi pengalamn tentang bagaimana ...

-

Kali ini saya akan berbagi pengalaman bagaimana cara mengatasi Printer Dotmatix Epson LQ 2180 lampu pause menyala terus........ kalau lam...

-

Pada kali ini saya mendapat pasien printer Canon ip1880, kerusakannya waktu printer narik kertas miring & tidak bisa masuk kertasnya.......

Tidak ada komentar:

Posting Komentar