There are many airline credit cards available today, but it is up to you

to earn the most miles/points possible. You will find how to earn

bonus miles, use business expenses to your advantage, and how to turn

normal purchases/budget expenses into miles/points. Let's discuss in

more detail how to maximize your card's earning potential.

Bonus Miles/Points

Some

airline credit cards will give a new card holder bonus miles for

choosing their card or even give double miles/points when you purchase

airline tickets. A little investigation into what each card offers

before applying can save you not only in interest and fees, but in

actual miles/points as well. In fact, some airline credit cards offer

as much as 25,000 miles just for choosing their card! A little research

in this area will definitely be to your advantage in getting the most

miles/points as quickly as possible.

Double Miles/Points

Another

avenue of quickly adding mileage/points to your account is by receiving

double miles/points for airline ticket purchases. Check to see if the

airline credit card companies you are interested in will double

miles/points for the purchase cost of a regular ticket charge. If you

travel frequently due to business or for personal reasons, these types

of miles/points credits could really add up quickly.

Business Expenses and Tickets

As

a business owner, you can use your airline credit card for business

expenses and earn miles to help offset the expense of your employees'

airline tickets for their business trips.

For personal

benefit, another approach is to charge business expenses to your airline

miles credit card that will be eventually reimbursed by your employer.

When you receive your travel check from your employer, make sure you

pay the balance owed by the due date and you will have miles/points

earned for a well-earned vacation!

Earning Maximum Miles/Points and keep the Interest Costs down

Since many airline miles credit cards have a higher interest rate than

other cards, to most effectively use your airline credit card without

running up unnecessarily high interest charges:

1) Use your card

to purchase as many items as possible; including paying off your monthly

bills without going over your usual monthly expenses already budgeted;

2) Immediately pay off any balances when your airline credit card statement arrives.

What will this accomplish?

1) It will credit your account with the maximum miles/points without incurring the high interest rates;

2)

Since you are earning miles/points quickly, you can enjoy the reward of

going on more trips or to a more exotic destination than by just

occasionally using your airline miles credit card.

Rewards

There

are so many ways you can reap the rewards of your airline miles credit

card, from saving money for your business expenses, finally being able

to take that dream vacation, to bringing home your child from college or

living far away . . . unlimited uses . . . unlimited dreams . . .

Conclusion

It

is up to you how quickly your reward miles/points add up. These ideas

are very simple, but if used correctly will give you maximum benefits

with minimal costs. Here is a quick checklist for your reference: 1)

Research alone can add up to 25,000 miles on your new card; 2) Add some

miles from airline ticket purchases; 3) Business expenses–either actual

business or personal business can be used to offset future business

expenses or used to enable personal trips. 4) Finally, converting simple

costs of daily purchases/budgetary expenses into miles/points will give

you countless opportunities to earn miles and points. I think you will

definitely find that these methods will enable you to earn miles and

points quickly with your new airline credit card.

Langganan:

Posting Komentar (Atom)

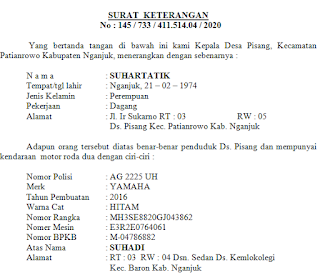

SURAT KETERANGAN STNK DAN BPKB untuk Hutang BANK

Surat ini biasanya untuk melengkapi administrasi pengajuan hutang ke Bank, biasanya juga disertai dengan SURAT KETERANGAN USAHA . monggo bi...

-

Alhamdulillah akhirnya AJ bisa post lagi......... lama juga AJ gk post. Langsung saja kali ini AJ akan berbagi pengalamn tentang bagaimana ...

-

Kali ini saya akan berbagi pengalaman bagaimana cara mengatasi Printer Dotmatix Epson LQ 2180 lampu pause menyala terus........ kalau lam...

-

Pada kali ini saya mendapat pasien printer Canon ip1880, kerusakannya waktu printer narik kertas miring & tidak bisa masuk kertasnya.......

Tidak ada komentar:

Posting Komentar